The cost of debt is up and spending cuts loom

Less than three months ago, Rachel Reeves delivered what was billed as a budget for growth. The chancellor raised employers’ taxes, rewrote the fiscal rules and set aside a £9.9 billion spending buffer.

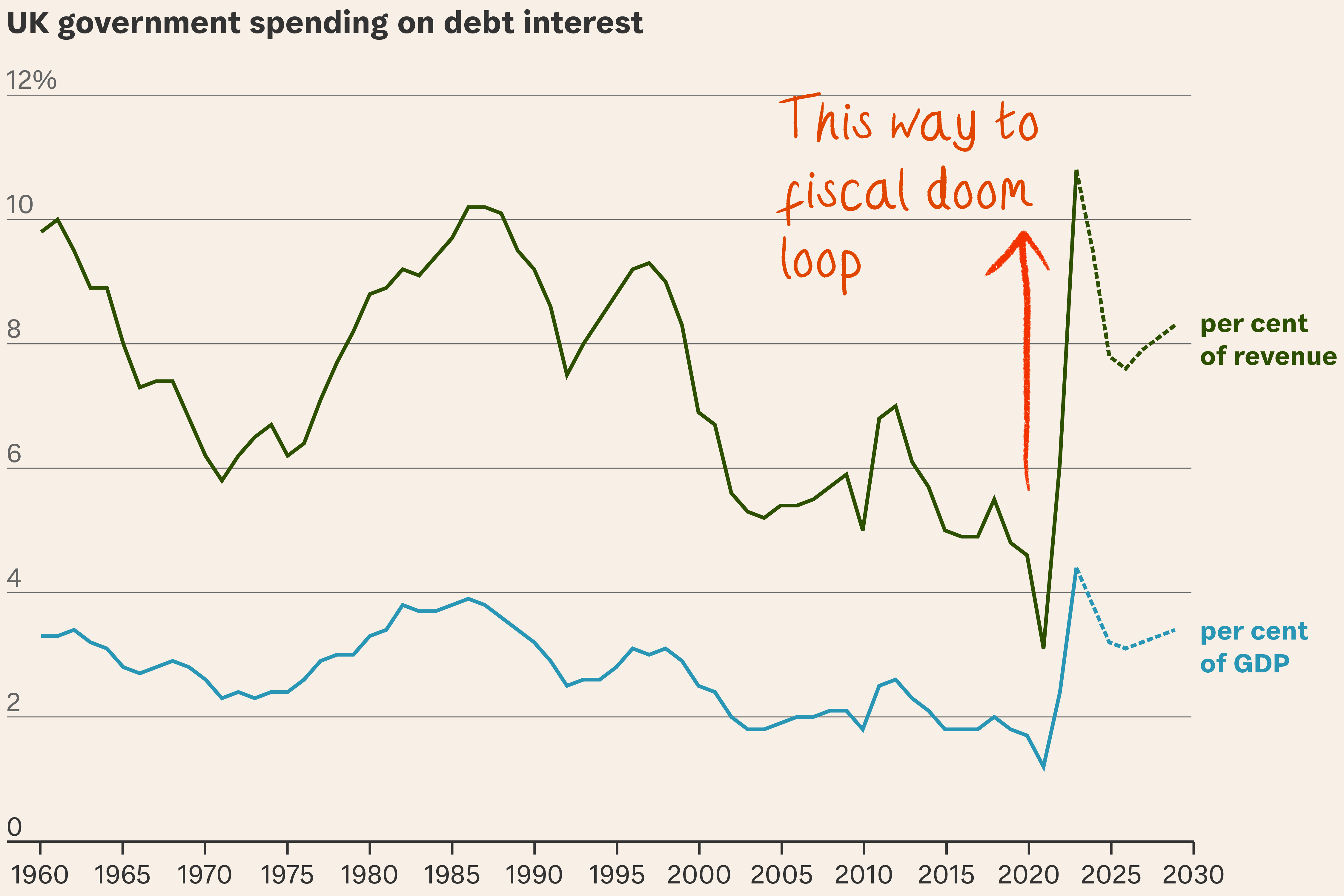

So what? That buffer looks close to evaporating this week as UK long-term borrowing costs hit their highest level since 1998. An increasing share of GDP, close to 3.8 per cent, is now going towards paying off debt interest instead of investing in public services.

Growth remains elusive, on top of which a Treasury minister in charge of fighting corruption resigned yesterday over her links to the ousted government of Bangladesh (more below).

This is not about people – but Reeves does look uncomfortable in a straitjacket woven from

- a self-imposed fiscal rule that day-to-day government spending must be covered by tax receipts;

- a pledge not to raise any of the three broadest taxes on income; and

- ringfenced spending budgets for defence (a pre-requisite to good relations with the US) and health (essential for improving productivity).

Vigilant or vigilantes? Bill Clinton’s chief strategist once quipped that if he were to be reincarnated, he'd return as the bond market because “you can intimidate everybody”.

That power has been on full display this week: bond yields, which move inversely to prices, have climbed on both sides of the Atlantic as traders digest the possibility that interest rates will have to stay higher for longer to tame inflation fuelled by new US tariffs.

But the UK is uniquely vulnerable, not least because nearly a third of its public debt is held by overseas investors. As the economist Tim Leunig points out, the rate of interest the UK government has to pay on ten-year gilts has risen a whole point from a year ago to 4.84 per cent – the biggest change of any major developed economy.

- In the US, the rate has climbed 0.8 per cent on the prospect of an expanded deficit and tariffs.

- In France, the rate climbed 0.7 per cent while the government wrangled a new budget.

- In Greece, it moved up just 0.1 per cent after a successful five-year campaign to halve the country’s swollen debt-to-GDP ratio.

The fiscal squeeze that results from having to pay higher interest on public debt could result in what gloomier economists call a “fiscal doom loop”.

Hostage to events. It's a small reassurance that the latest sale of UK debt had solid interest despite the turmoil. In addition, inflation for December came in a tenth of a percentage point lower than feared, making another run on bonds less likely.

Further down the line, eyes are fixed on the next forecast of the OBR spending watchdog, in March, and beyond that to the government’s spending review, due in June.

Nowhere to hide. More taxes are electoral kryptonite. Borrowing begets more borrowing. Reeves’s straitjacket leaves her with one realistic option: cuts. John McDonnell says they would be “political suicide” but Starmer has backed her to be “ruthless” and the big question now is where the axe could fall. Candidates include:

- the £300 billion a year welfare budget;

- the civil service, which Starmer says is “a lever that hasn’t been pulled enough”; and even

- the triple lock on pensions, which guarantees the state pension will rise by the highest of inflation, wages or 2.5 per cent.

But after seven months of government, one budget and two close shaves with the bond markets, Reeves no longer has the gift of time. The choice is between boosting growth or austerity 2.0.

Finding some wriggle room. The problem with growth measures laid out in the budget on housing, energy and health is that they will take years to be felt. Hence a set-piece in the coming weeks to lay out a “plan for growth”. Efforts aimed at reducing the barriers to hiring would be a good start, especially since many businesses are adjusting headcount in light of the rise in employer national insurance. A more optimistic tone might help too.

What’s more… Higher interest rates will add £1.27 billion to the annual housing costs for 700,000 UK property owners remortgaging in 2025, according to Savills. The sell off in UK debt, if it persists, could make that worse.