It’s the tip of an iceberg of risky deregulation

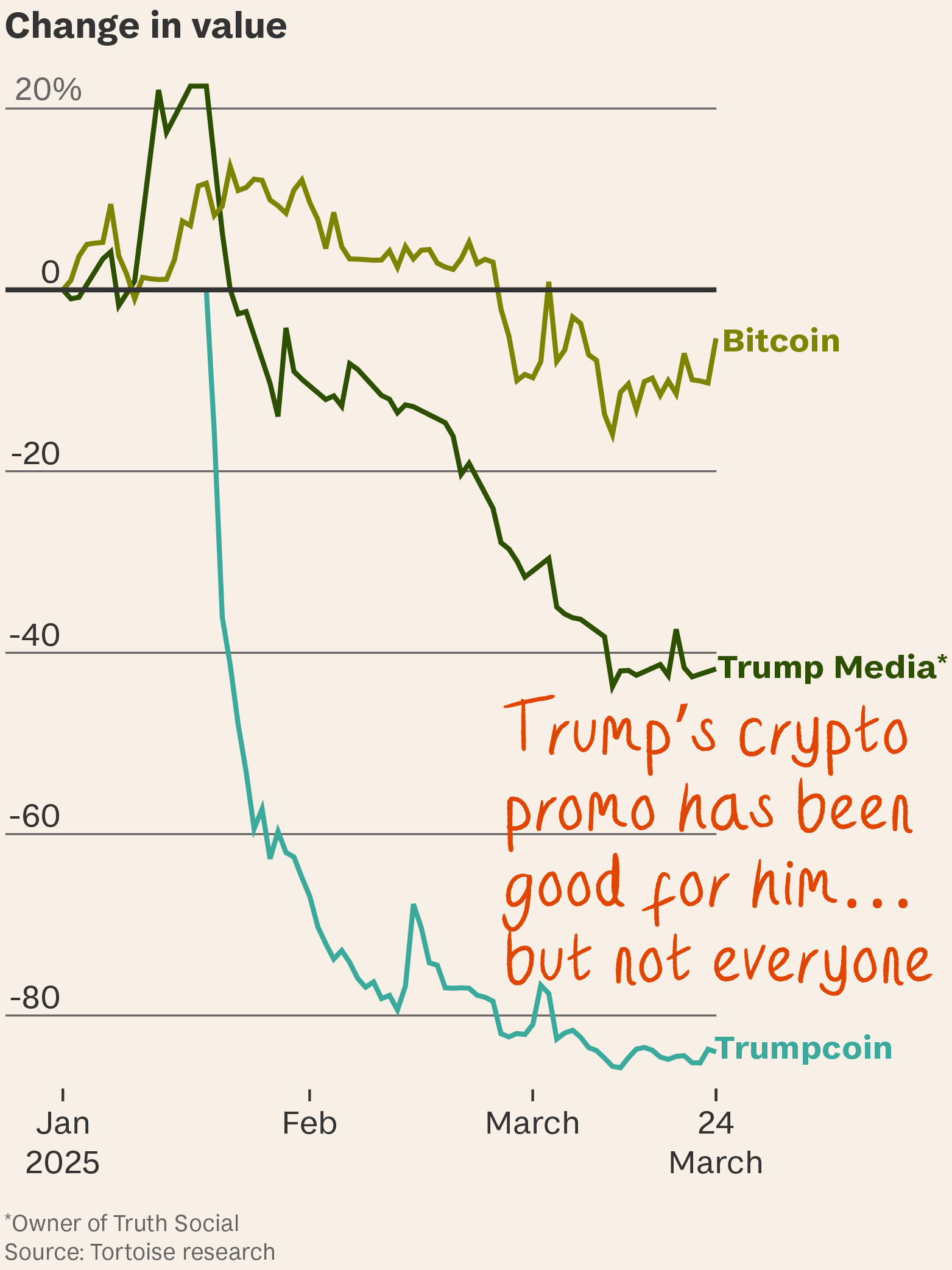

Entities linked to Donald Trump have made nearly a billion dollars from digital assets like crypto and NFTs since late 2022, Tortoise has found.

So what? Trump isn’t just personally profiting from crypto; he’s rewriting the rules for everyone. Since his second inauguration he’s

- signed an executive order to create a ‘Strategic Bitcoin Reserve and Digital Asset Stockpile’, made up of other cryptocurrencies;

- fired Gary Gensler, former head of the Securities and Exchange Commission, the market regulator, and replaced him with a crypto-friendly acting chair; and

- dropped or paused multiple high-profile lawsuits against crypto companies.

Trump once said bitcoin was a “scam”, but he is now hailing a new era of deregulation. In the short term his policies could make him richer by inflating the value of his personal crypto holdings. In the long run such a rapid shift in the markets could trigger a financial crisis on the scale of 2008, says Corey Frayer, former head of crypto policy at the SEC.

Deregulation, baby. Under Biden – and in the wake of the 2022 collapse of FTX, Sam Bankman-Fried’s crypto exchange – the SEC filed more than 120 lawsuits against the crypto industry. They’re dropping like flies:

- In the past few weeks, the SEC has dismissed cases against Ripple, Coinbase, Kraken and Consensys, and dropped multiple investigations into other companies.

- The regulator dropped a high-profile case that alleged the Binance crypto exchange artificially inflated trading volumes, misused customer funds and misled investors. In 2023, Binance pleaded guilty to violating US money-laundering rules in a separate criminal case. Changpeng Zhao, its founder, is serving time on a related charge.

- Zhao is lobbying Trump for a pardon, as is Bankman-Fried, who told Tucker Carlson in an interview from prison this month that he’s “not a criminal”. (Bankman-Fried is serving 25 years for fraud and misuse of customer funds.)

Crypto executives are celebrating. Ripple’s CEO welcomed the “largest economy in the world finally taking a pro-crypto and pro-innovation approach” to a technology that he said can “solve real-world problems”.

Critics say this is a technology that has little to do with the real world unless properly regulated. “[The SEC] basically told the markets: ‘you can do whatever you want’,” Frayer says. “And it told investors: ‘you're completely on your own’... and that’s going to leave the country in a really bad position.”

Why now? Trump’s views on crypto may have changed when the industry’s leading super Pacs spent more than $160 million backing his campaign. His personal enrichment could also have something to do with it:

- The WSJ recently reported that representatives of the Trump family have held talks about investing in Binance.

- World Liberty Financial, a crypto project backed by the Trump family, said last week it had sold $550 million in tokens.

- Research by the FT found that two companies linked to Trump earned $314 million from token sales and $36 million in trading fees from launching and controlling the supply of Trump’s official memecoin, released three days before his inauguration.

What could go wrong? Plenty. David Sacks, Trump’s crypto czar, has estimated US federal agencies currently hold 200,000 bitcoins worth £16.7 billion, often seized from criminal and civil forfeitures. Confiscating them and putting them in a reserve still requires congressional approval. If successful a “strategic reserve” would give the government an interest in crypto prices and provide a backstop for speculative assets mostly paid for by US taxpayers.

It could also

- bloat government spending; and

- damage the dollar’s status as the world’s reserve currency.

Following the approval of bitcoin exchange traded funds last year, crypto is becoming more embedded in the rest of the financial system. Frayer says “ a crash in the crypto markets, which happens with some regularity, could certainly take down important players”. Another source working in finance said Frayer’s claims were “exaggerated”.

What’s more... Anthony Scaramucci, crypto investor and former White House comms director for Trump, says the president’s stance on the industry is the least of his concerns. “If he’s going to reorder the world and he’s going to cripple Europe and he’s going to side with Putin, that’s not going to be long term good for your crypto.”