The House of Lords’ threshold for disclosure is 100 times higher than the US Senate’s

Dozens of peers own stakes in the UK’s biggest companies, spanning sectors including banking, defence, mining and energy, that have effectively been held in secret – until now.

So what? More than 50 members of the House of Lords have unregistered shareholdings worth at least £1.3 million between them on current valuations, Tortoise has found. Owing to restrictions on access to the data, the real figure is likely to be far higher.

Peers are required to register shareholdings only if

- they hold a controlling share in a company; or

- their stake exceeds £100,000 in value.

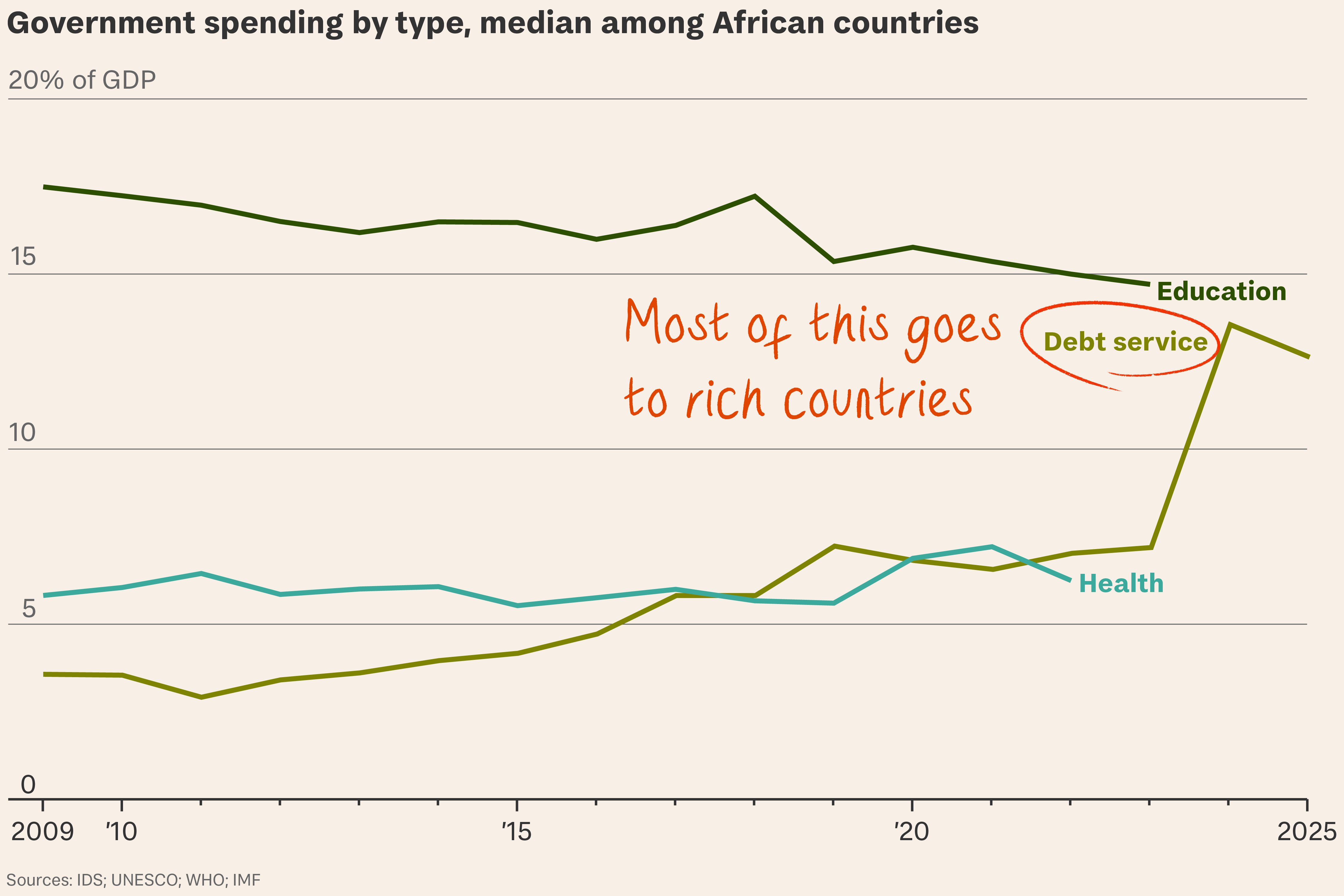

High bar. That is much higher than the £70,000 threshold for MPs and 100 times higher than for US senators. Even above this threshold, peers don’t have to state the value of their investment.

They are also expected to declare any financial or non-financial interest which may be relevant to a debate, including for investments below the threshold.

Low light. In reality the voting public is often left in the dark about possible conflicts of interest that may arise when peers are debating and shaping legislation.

As part of our Peer Review investigation, Tortoise is able to shed light for the first time on the precise amounts held by peers in FTSE100 companies that responded to our data requests, so the public can see which legislators have significant stakes in companies affected by the laws they debate.

Including shareholdings that have been registered, members of the House of Lords own, or have in the last month owned, shares worth at least £3.9 million in companies including BAE Systems, Rio Tinto, Astrazeneca and Shell.

Mine the gap. At least two peers hold shares worth between £70,000 and £100,000, meaning they benefit from the discrepancy between the two chambers, despite the fact that both pass laws affecting the whole country.

The threshold for declarations was doubled last year from £50,000. If it had remained at the same level, more peers would be required to publish which companies they are invested in.

“There’s an irony that it’s easier to find who has shares in private companies than it is in PLCs,” Steve Goodrich of Transparency International UK said. “It shouldn’t take the work of investigative journalists to dig out conflicts of interest in our legislature.

“There’s a strong argument for Lords being more open about their shareholdings, and PLCs more transparent about their shareholders.”

A House of Lords spokesperson said the threshold increase reflected inflation and share price changes. “The requirement to register shareholdings provides transparency, as does the requirement for members to declare shareholdings below £100,000 if relevant to business in which they are engaged in the House or in a Committee,” they said.

The threshold for disclosure for British parliamentarians, both MPs and peers, is far higher than in many Western democracies, in Europe as well as North America.

Obtaining data on shareholdings is challenging, despite the fact the shares are owned by public figures:

- Proper purpose. Share registers can theoretically be accessed if a member of the public or a journalist puts in a formal request that satisfies stringent tests to ensure the registers will be used for a “proper purpose”.

- Proper money. Access to these registers has to be paid for, however, and Tortoise’s requests have been declined by more than half the companies in the FTSE100, some of them taking advantage of being based offshore.

Susan Hawley, executive director of Spotlight on Corruption, said: “It is quite extraordinary that it should be so hard to find out significant shareholdings by sitting peers – international bodies have long recommended that the UK lower the reporting threshold for shareholdings, and this kind of transparency is essential for preventing conflicts of interest by those who scrutinise the country’s legislation."

Despite this the data that has been obtained gives a first look at information that has until now been denied the public, at a time when reform of the House of Lords is high on the political agenda.

What’s more… In further reporting Tortoise will examine instances of peers speaking in debates or submitting written questions about topics relevant to their shareholdings.

All share valuations have been taken from the close of the markets on 3 December. Shareholding data is from registers received between October and November 2024.