At a new peak price of over $70,000, Bitcoin is confounding many of its sceptics.

Bitcoin is back, surging to a new high and eclipsing memories of its 2022 crash.

So what? It could crash again, in which case the question is how far it would fall and at what risk to the wider financial system. Or it could join the financial mainstream, in which case its adoption may just be getting started.

Multiplier effect. The digital token briefly hit a record of more than $73,000 earlier this month, up from $0.09 in 2010 (so that anyone who bought $10-worth then and hung onto it would be holding Bitcoin worth more than $8 million now).

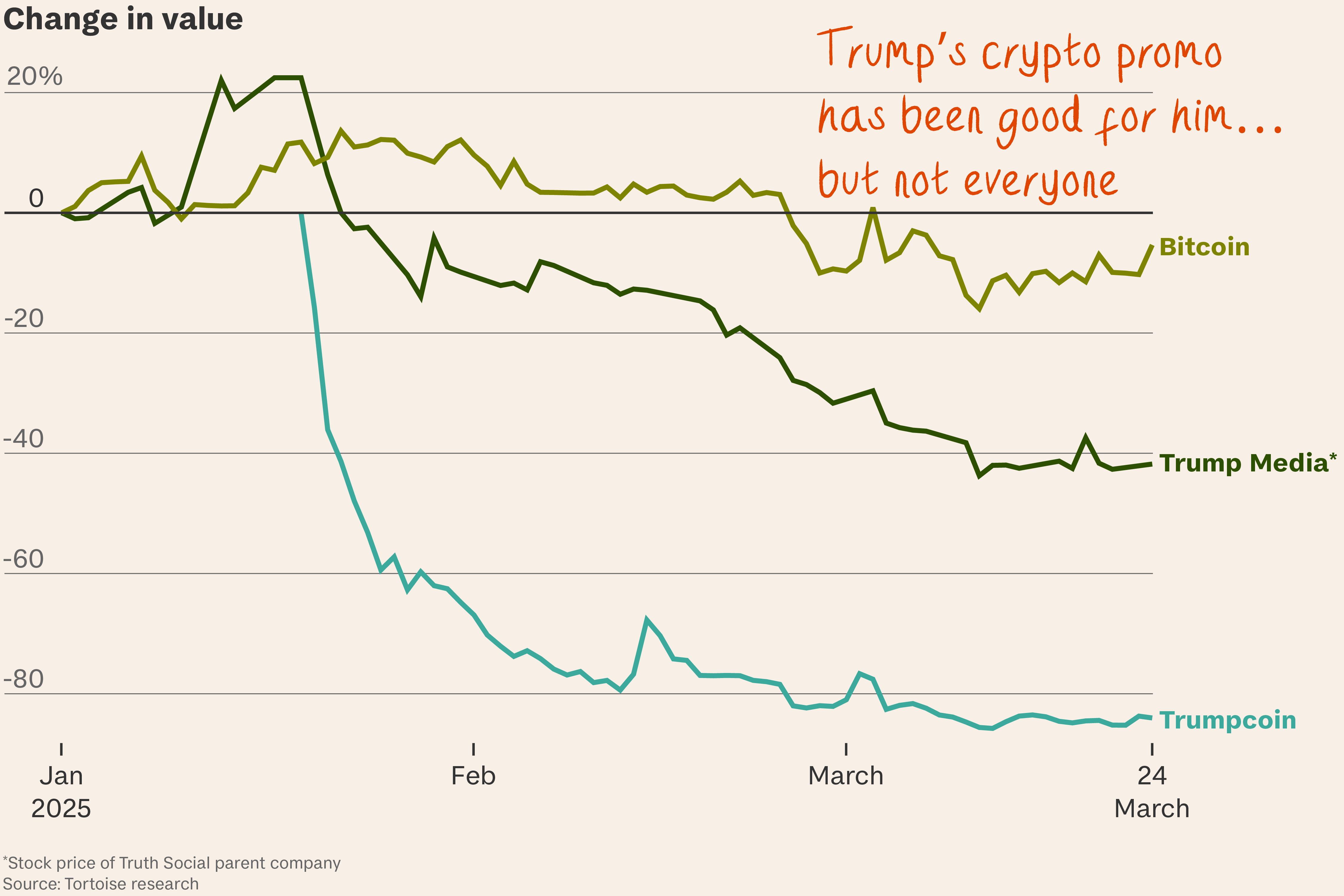

The latest surge appears to have been driven partly by

- the arrival of crypto exchange traded funds (ETFs) – allowing investors to buy shares in funds that own crypto; and

- expected interest rate cuts (on which more below).

Its popularity is rising. UK regulators estimate that 10 per cent of the UK population already owns crypto directly (mostly Bitcoin), with ownership skewing male and younger.

Not everyone is euphoric. Vanguard, the world’s second biggest asset manager, says it has no plans to offer a Bitcoin ETF, and calls crypto “more of a speculation than an investment”.

That points to two of crypto’s risks:

To the financial system. Other tradable assets – from coffee beans to houses – have underlying usefulness. Crypto is, in the words of US regulator Gary Gensler, a “speculative, volatile asset” that’s also used for money-laundering and financing terrorism. Another wild swing in the price could cause panic that spills into the rest of the economy. One financial regulation expert, speaking anonymously, said no one really understands what drives crypto prices from day to day, “and they are subject to manipulation by a range of players, most of whom are outside the UK”.

It’s still a small part of the financial system – but so were securitised subprime mortgages in 2007.

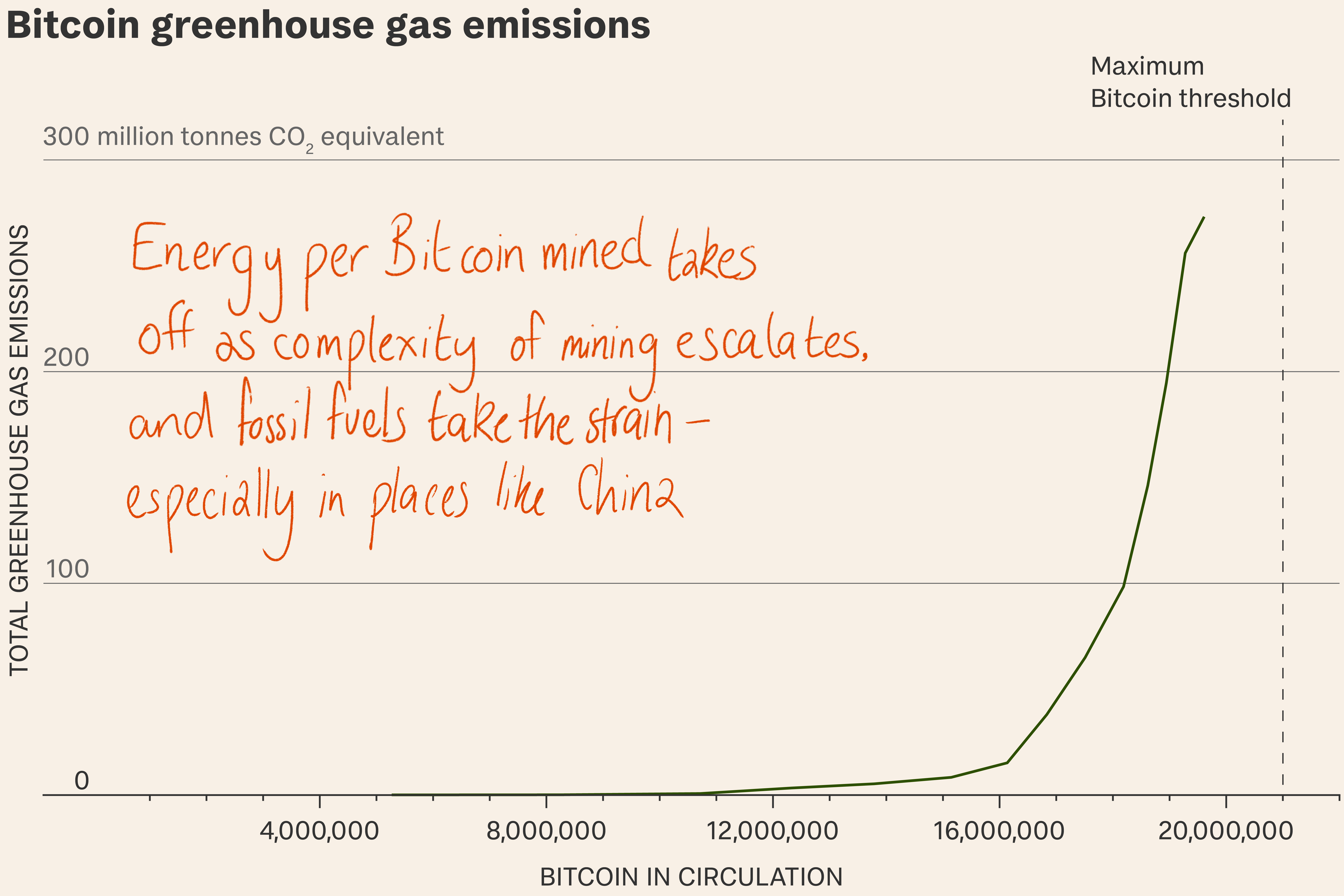

To the planet. The hunger for energy of Bitcoin “mining” – in which specialised computers race to solve puzzles in exchange for new coins – has revived the use of some fossil fuel power plants. New York state has since imposed a moratorium on new fossil fuel powered crypto mining. Worldwide, Bitcoin is thought to have consumed about 100 terawatt hours of electricity in 2022 (equivalent to the power consumption of countries like Belgium or the Netherlands). It produces more greenhouse gas emissions than Greece or Kenya, according to the Cambridge Bitcoin Electricity Consumption Index.

As countries transition to net zero, there’s likely to be increasing pressure on energy use for Bitcoin mining. Swedish regulators have said renewable energy in their country should be channelled to essential services rather than Bitcoin, and other governments may follow suit.

A bubble? Maybe not. There are three reasons to think Bitcoin will continue to rise in value.

- Halving. The next Bitcoin “halving” is due next month. This means the number of coins awarded to miners for completed calculations will fall from 6.25 to 3.125, raising the production cost and slowing the supply of new coins. Previous halvings have coincided with gains.

- Rates. If the US Federal Reserve cuts interest rates this year, as expected, investors are more likely to seek riskier assets that promise higher returns.

- Dictators. Crypto is a hedge against the rise of authoritarian regimes. Bitcoin is popular in Russia and Turkey. As Larry Fink, chief executive of Blackrock notes: “If you’re in a country where you’re fearful of your government – and maybe this is one of the reasons why China has banned it… you could say this is a great potential long-term store of value.”

Sam Bankman-Fried, founder of the FTX crypto exchange, awaits sentencing this month for one of the biggest frauds in financial history. Despite that, crypto looks set to recover and even become respectable.

What’s more… The blockchain technology that keeps a secure record of crypto transactions may yet serve as the backbone for digital currencies that eliminate the need for bank accounts. That’s a transformation which has only just begun.

More than 70 countries are holding elections this year, but much of the voting will be neither free nor fair. To track Tortoise’s election coverage, go to the Democracy 2024 page on the Tortoise website.