Facing nearly half a billion dollars in fines excluding interest and lawyers’ fees, Trump may have to start selling real estate.

On Monday Donald Trump paid the New York Times $392,000 after losing a lawsuit over a 2018 investigation by the paper into his finances.

Yesterday he asked a New York court to accept a bond worth $100 million to cover penalties nearly five times as large – and was turned down.

So what? This is just the beginning. The Supreme Court’s decision to hear Trump’s claim of presidential immunity has delayed one criminal trial on charges of 2020 election interference, which will help his 2024 run. But Trump is entering a season of legal payouts which, set against campaign fundraising running far below 2020 levels, could mean his poll numbers aren’t the ones that count, or hurt.

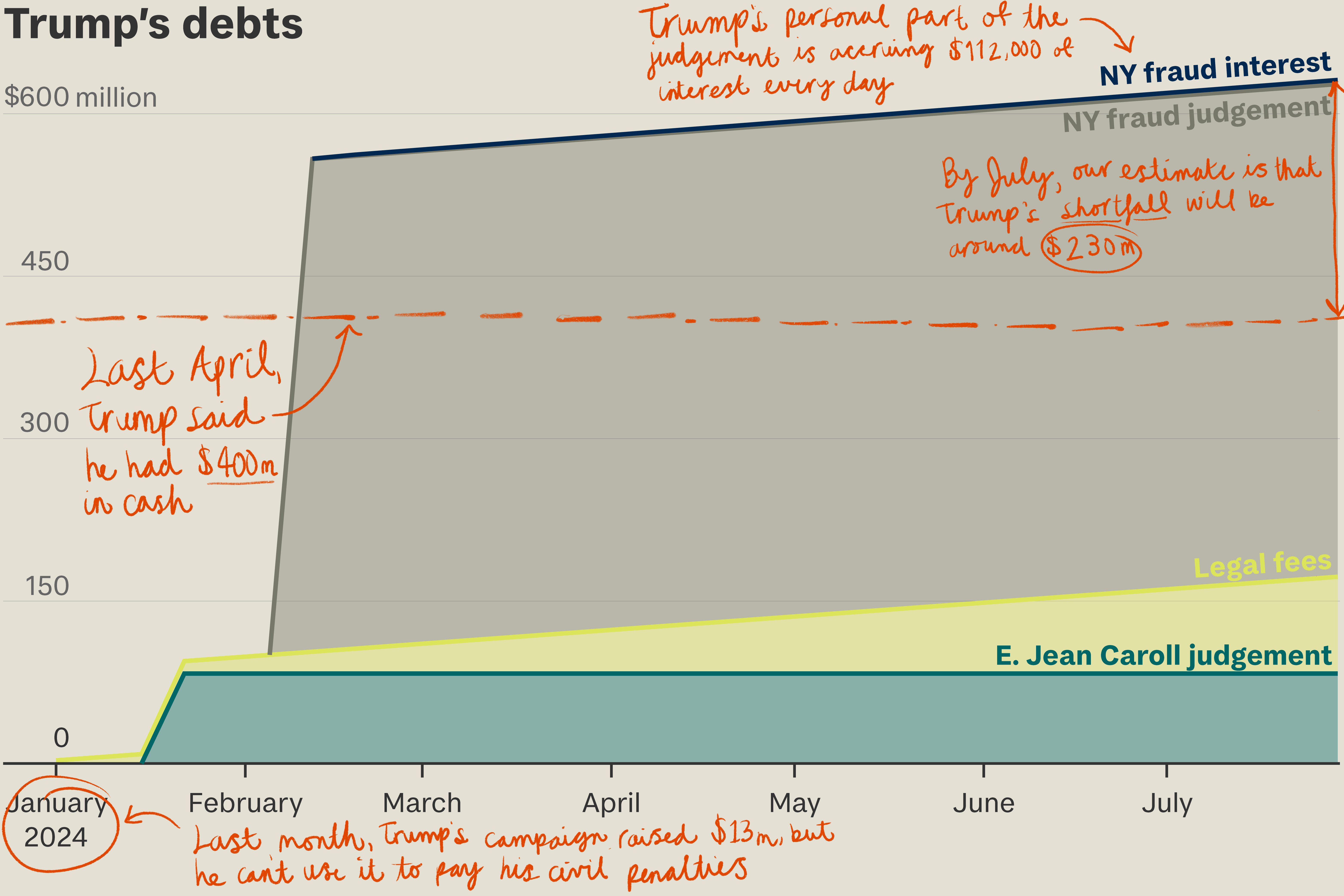

- Trump owes around $430 million in two civil court cases.

- He can appeal, but he still has to put up the full amount in cash or bonds while waiting for the verdict.

- In the meantime he’s also liable for interest running at $112,000 a day.

He can use campaign funds to help pay legal bills – but not to pay out on the civil suit judgments, which are so big they could force him to start selling the trophy properties that underpin his brand.

Those funds. Federal Election Commission filings this week show the Trump campaign raised a weak $13.8 million in the past month. The campaign spent $3 million more than it raised in January, covering the Republican primaries as well as the candidate’s legal fees. His small donor numbers peaked with his four criminal indictments last August, but have fallen steeply since. In November he had 143,000 low-dollar donors to Biden’s 172,000.

Those fees. Save America, a Trump-aligned Political Action Committee (PAC), spent $2.9 million on Trump’s legal fees in January alone. Last year, it spent $51 million. Professor Bennett Gershman of Pace University Law School estimates Trump’s total legal bill for the four cases will top $150 million.

Court fines. Trump owes

- $83.3 million in damages in the defamation case brought by E. Jean Carroll, the journalist who accused him of assaulting her in a Bergdorf Goodman changing room; and

- $355 million in the fraud case brought by New York state for inflating the value of his properties as loan guarantees.

Deadlines. He’s appealing both fines but has to show he’s good for them within 30 days of the judgement – due in two weeks in the Carroll case and by 25 March in the fraud case.

At this rate, Trump’s money available for legal fees could run out by July.

Ripped off. Trump’s problem in raising a bond, says Martin Sheil, a former federal tax official, is his reputation. In the New York construction business, Sheil says, “Everyone knows someone who was ripped off by Trump… A surety company might accept Trump’s properties as collateral, but if he loses and doesn’t pay, the company would have to try to get the property. Trump doesn’t believe in obeying the law – he believes in manipulating the law. That’s high risk.”

Can he pay? Not easily. Forbes puts his net worth at $2.6 billion, most of it tied up in real estate. In a court deposition last April he said he had roughly $400 million in cash, but yesterday’s failed bid to cover his fines with a $100 million bond suggests that may have been an exaggeration.

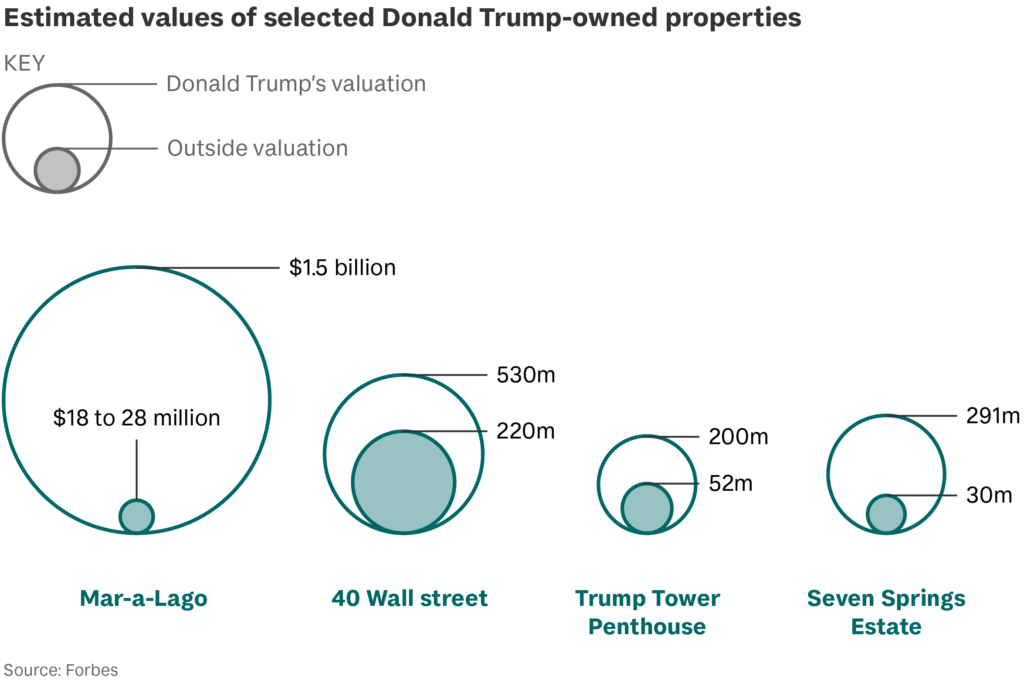

What about a fire sale? In the same deposition Trump listed “glamour assets” including Trump Tower, 40 Wall Street, Mar-a-Lago, Bedminister, the Turnberry Golf Club in Scotland and the Seven Springs estate in Westchester County. He claimed Mar-a-Lago was worth $1.5 billion.

Reality. It isn’t. A ruling last year by Justice Arthur Engoron in the New York fraud case noted that the Palm Beach County assessor appraised Mar-a-Lago at between $18 million and $28 million; and that Trump had wildly over-valued his other properties too.

Brand value. His Truth Social network could be his best hope, giving him a stake worth up to $4 billion if it goes public. But that could be wishful thinking. Jay Ritter, finance professor at the University of Florida, calls Truth Social a “meme stock.”

What’s more… The appellate judge paused Judge Engoron’s three-year ban on Trump borrowing money from New York banks, which could help him secure a bond. But Trump is still an expensive risk. Time to scrimp and save.

More than 70 countries are holding elections this year, but much of the voting will be neither free nor fair. To track Tortoise’s election coverage, go to the Democracy 2024 page on the Tortoise website.