Banks, businesses and investors are hedging against a second Trump presidency

Donald Trump’s media company, Truth Social, was briefly worth more than Elon Musk’s X on Tuesday. Shares in the group that owns Truth Social – of which Trump is the main holder – have quadrupled in value from a record low in late September, putting its market cap at over $10 billion.

So what? Even if you ignore the rally in Trump’s memestock, it’s clear that Wall St is pricing a Republican win on 5 November. Banks including JPMorgan and Citibank have been making “Trump Trades” since October and earlier, hedging against widely-expected trade and inflation shocks if he regains the presidency.

Last week a note from JPMorgan identified three indicators that suggest investors are locking in “Trump trades”:

- Shorting bonds. 10-year Treasury yields have risen 0.6 per cent since mid-September as investors dump bonds. The uptick is driven by the assumption that Trump’s agenda of tariffs, lower taxes, and anti-immigration laws will juice inflation and interrupt the Fed’s rate-cutting cycle. Analysis of Trump’s vague policy platform suggests his re-election could lead to an additional $7.5 trillion in US Treasury debt issuance over a decade.

- Buying small. Small and mid-cap companies have outperformed larger peers on hopes of lower taxation and deregulation. Private prison operators like Geo Group and CoreCivic have seen stock prices rise between 10 and 20 per cent this month, as investors bet that a crack down on illegal immigration will fuel demand for detention centers.

- Dollars. The currency has climbed over 4 per cent since mid-September against a basket of rivals. Trump has long indicated he’d like to see the dollar weakened, but an association in the minds of traders between his stated policies and inflation has produced the opposite effect.

“From the early part of October, we’ve definitely moved into a position that was more favorable for being long on the dollar versus the Euro and Sterling, and our portfolio is geared towards generating performance from yields rising rather than yields falling,” says Russel Matthews at RBC BlueBay Asset Management. “We’ve taken the view that Trump is more likely to win this election than Harris.”

Premature? Maybe. DJT, the trading ticker for Trump’s media group, has plunged over 25 per cent since its high earlier this week. The move in Treasury yields could also be driven by the assumption the US economy will continue its robust growth, or that the Fed hasn’t moved fast enough. Election prognosticators come in many shapes, from hedge funds to punters, and they’re seldom consistent or right.

One mythical predictor is the S&P 500. If the index is rallying, the theory goes, the incumbent wins. Data collected by LPL Financial shows that in 20 of the last 24 presidential contests, that’s been the case, including in 2016, when Trump’s win shocked the world. The S&P500 has climbed 10 per cent since August.

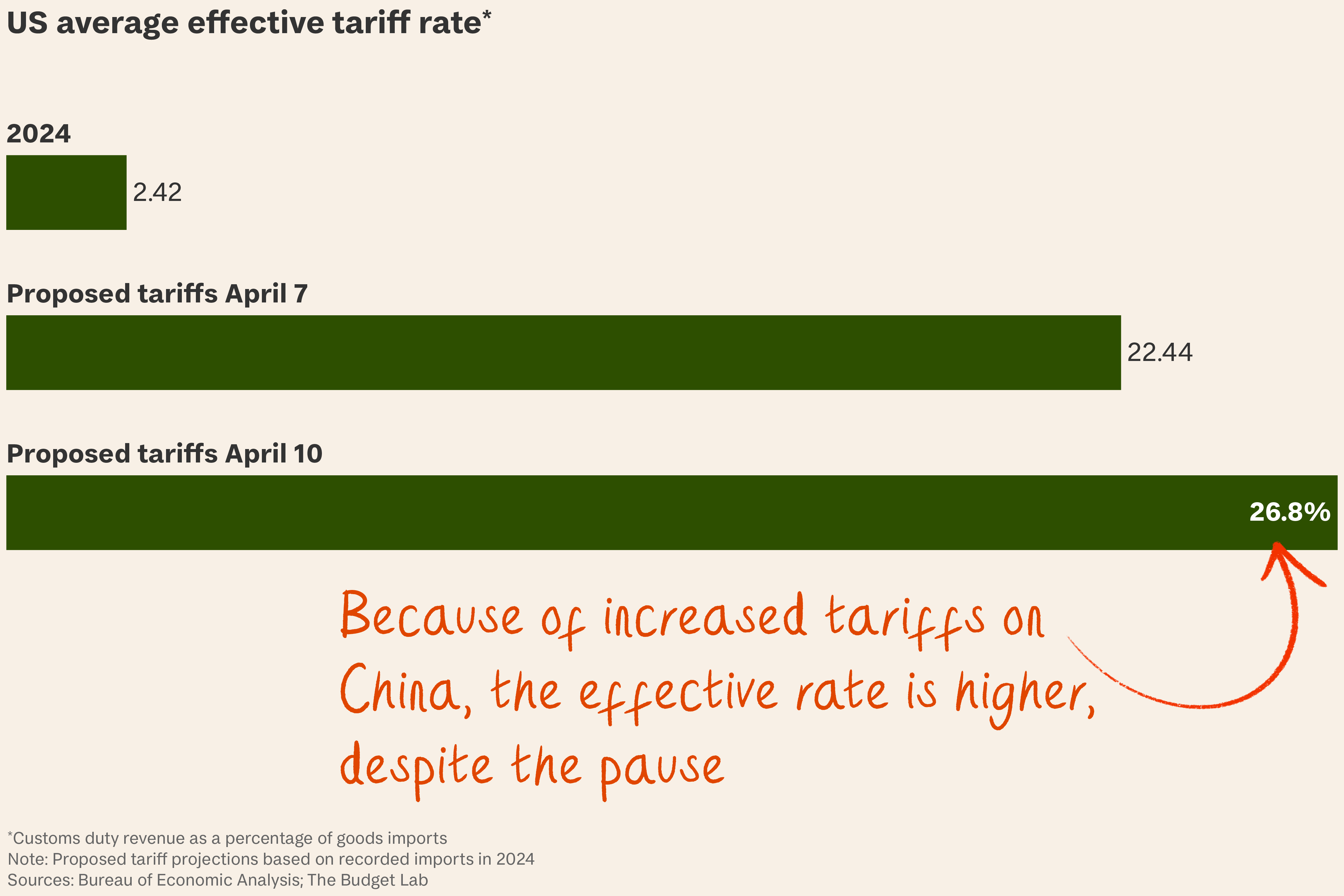

The bigger picture. Betting on Trump is a poisoned chalice. Last week, without naming him, the deputy MD of the IMF, Gita Gopinath, said that “very serious decoupling [with China] and broad scale use of tariffs could end up with a loss to world GDP of close to 7 per cent” – equivalent to the economies of both France and Germany.

Trump has not produced a precise trade policy, but has indicated he could slap tariffs of

- 10 or 20 percent on everything imported from abroad, and

- a higher rate of 60 per cent on imports from China.

An estimate by the Peterson Institute for International Economics puts the annual cost of such a package at $2,600 for a typical US household. The key architect of Trump’s “Tariff Man” agenda is Robert Lighthizer, the former top trade official in his previous administration. The NYT says he’s in the running for Treasury or commerce secretary this time around.

What’s more… Investors are increasingly aware of Trump’s tendency to bully individual companies. Last month he threatened the tractor-manufacturer John Deere with 200 per cent tariffs if it didn’t abandon plans to move jobs and production from the midwest to Mexico. Its stock is down 10 basis points since then.