They weren’t a disaster first time around, but they could be next time

Last year Robert Lighthizer wrote that by running a trillion-dollar trade deficit with China the US was “literally trading the future control of our country… for current consumption – cheaper TV sets and sneakers.”

He called this “madness”.

So what? Lighthizer was US trade representative in Donald Trump’s first term. Now Trump wants him to do the job again.

The stakes are high. The world’s biggest economy is on a roll – and the US economic policy establishment says the real madness is Trump’s new plan for sweeping tariffs and tax cuts; that as a recipe for jobs and growth it simply won’t work.

Define work. The view of Trumponomics from inside Trump world is very different. They say that first time round it

- brought back jobs and profits;

- showed the rust belt who was on its side; and

- raised useful revenues in tariffs.

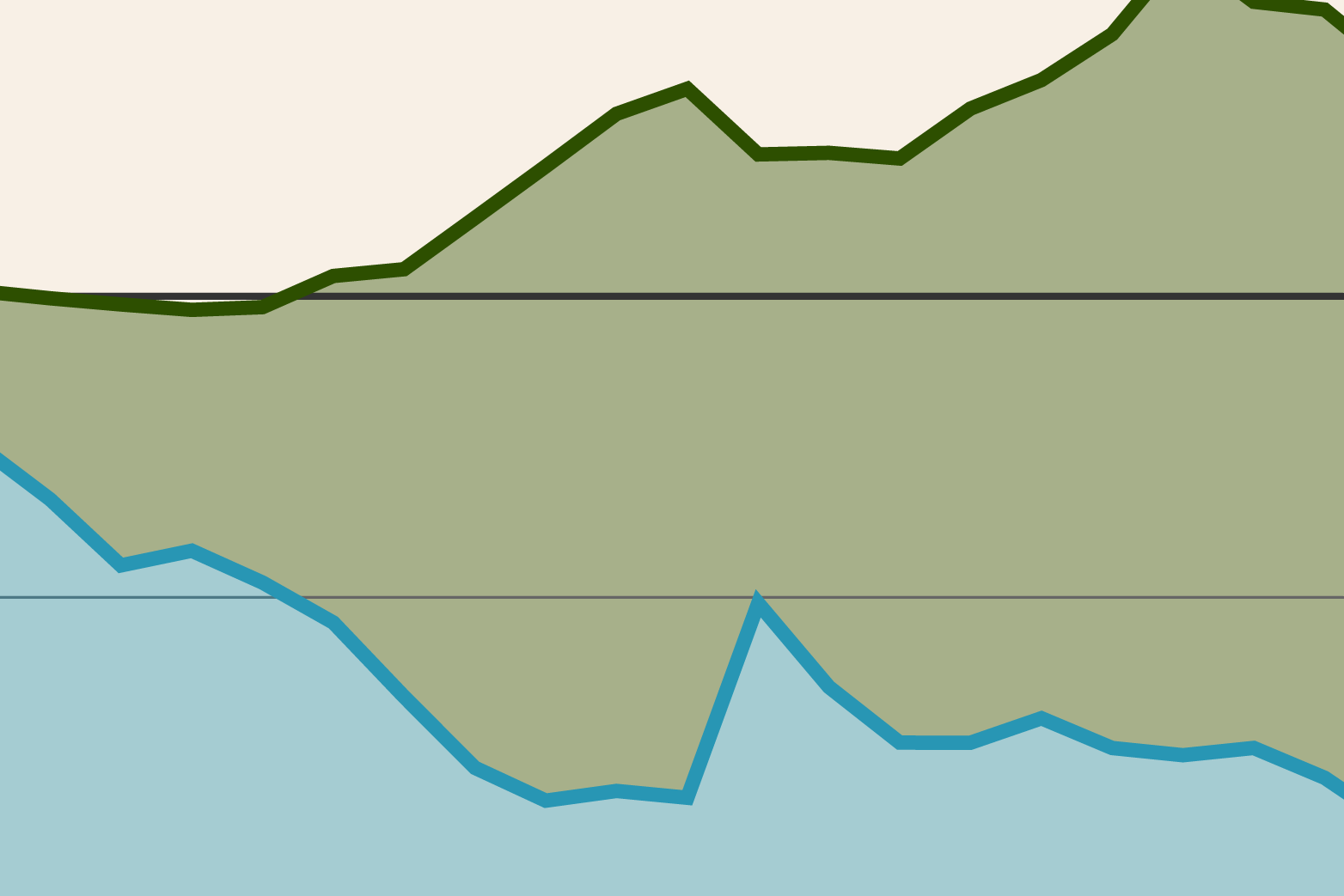

Was any of this true? In a sense. Trump’s tariffs between 2018 and 2020 brought in $50 billion in extra tax revenue and the corporate tax cuts that preceded them prompted the repatriation of $1 trillion in US companies’ profits previously parked offshore.

The message now is that was just the start. Brace for 10 per cent across-the-board import tariffs, 60 per cent tariffs on Chinese goods and tax cuts that could add $5 trillion to the national balance sheet, according to the Committee for a Responsible Federal Budget.

Please don’t. The classic free traders’ critique of tariffs is that they fuel inflation by raising import prices and hurt exports and growth by provoking tit-for-tat tariffs in other countries. Phil Gramm, a Republican former chair of the Senate banking committee, notes that

- the first Trump tariffs actually stunted growth and failed to halt a steady decline in manufacturing jobs; and

- the second Trump plan would have a “convulsive” effect on the US economy by trebling the average tax on imports and draining efficient, high-tech sectors of people and capital in favour of inefficient ones.

We get that, but… Lighthizer rejects this critique as naïve about other countries’ attitudes to the US, and wrong in that it’s based on the idea that “maximising consumption, efficiency and business profits [is] the supreme objective of economic policy”.

- In trade deficits he sees a mechanism for permanently shifting wealth abroad in return for the instant gratification of cheap imports.

- On China he believes “we are building their economy and their military” to the tune of $300 billion a year. A 60 per cent tariff could cost China 2 per cent of its projected GDP growth.

Reality, Trump 1.0. A widely-cited paper by Pablo Fajgelbaum and others based on county-level data found that the 2018-20 Trump tariffs on steel, washing machines and other selected goods

- had little direct effect on jobs but did hurt consumers who bore the full impact of higher import prices;

- hurt rural Republican counties in particular because of retaliatory tariffs imposed by China on agricultural produce; and

- caused a statistically insignificant overall 0.04 per cent hit to US GDP.

Reality, Trump 2.0. This remains to be seen. The threat of steep new tariffs could be a negotiating tactic for better market access abroad. Goldman Sachs expects actual tariffs on Chinese goods to be levied at 20 per cent, not 60. Deutsche Bank forecasts a short-term 0.5 per cent boost to US GDP if Trump sticks with his tax cuts but drops the tariffs; and a modest hit to GDP if he sticks with both.

Minnows. Smaller economies like the UK (where trade accounts for 65 per cent of GDP) are more vulnerable to US tariffs than the US (15 per cent). The National Institute of Economic and Social Research estimates the Trump tariffs could halve the UK’s projected GDP growth.

Manufacturers. Most US manufacturers who’ve outsourced production to China say they’ll move it to other low-wage countries rather than “reshore” to the US. Apple is gearing up iPhone capacity in India but not at home.

Voters don’t seem to mind either way. It’s the fact Trump launched a trade war on their behalf that they remember. A Harvard paper published in January found residents of “tariff-protected” locations became less likely to identify as Democrats and more likely to vote Trump in 2022.

What’s more… That seems to have held true in 2024.

Chart of the Week