Oil and gas companies made record profits last year. What does that mean for net zero?

The numbers are jaw-dropping – $59 billion at Exxon, $40 billion at Shell, nearly $28 billion at BP. A blockbuster year for oil company profits was accompanied by a scaling back of green ambition.

But here’s another straw in the wind. The environmental law not-for-profit ClientEarth said last week that it was bringing legal action against Shell’s directors for failing to manage climate risk properly. The lawsuit is backed by institutional investors including UK pension funds Nest and the Swedish national pension fund AP3.

So what? The signals from the market are, to say the least, confusing. On one hand, the listed oil companies doing most to shift to renewable energy have received little recognition for their efforts. BP’s shares went up when it said it would pump more oil. On the other, major asset managers – at least in Europe – are putting pressure on Big Oil to decarbonize faster.

The good news on climate change is that we are close to a major turning point on emissions.

- Solar and wind generated more than a fifth of the EU’s electricity last year, overtaking gas for the first time. The increase in coal use was a blip.

- Even on our current trajectory, global carbon emissions from energy are forecast to peak this decade.

- Both the Russian invasion of Ukraine and America’s Inflation Reduction Act are expected to bring emissions down.

The bad news is that this still isn’t happening fast enough. To avert the worst consequences of climate change, human-made emissions need to be reduced by 45 per cent on 2010 levels by the end of this decade. That will need a dramatic shift in current government policy.

Here’s where the energy majors come in. In a world that’s going to keep using fossil fuels, short-term projects with high rates of return are going to make business sense – especially if it’s accompanied by an obligation to remove carbon from the atmosphere.

The graver challenge to hopes of a liveable planet is investment in long-term hydrocarbon projects such as TotalEnergies’ plans to drill for oil in Uganda.

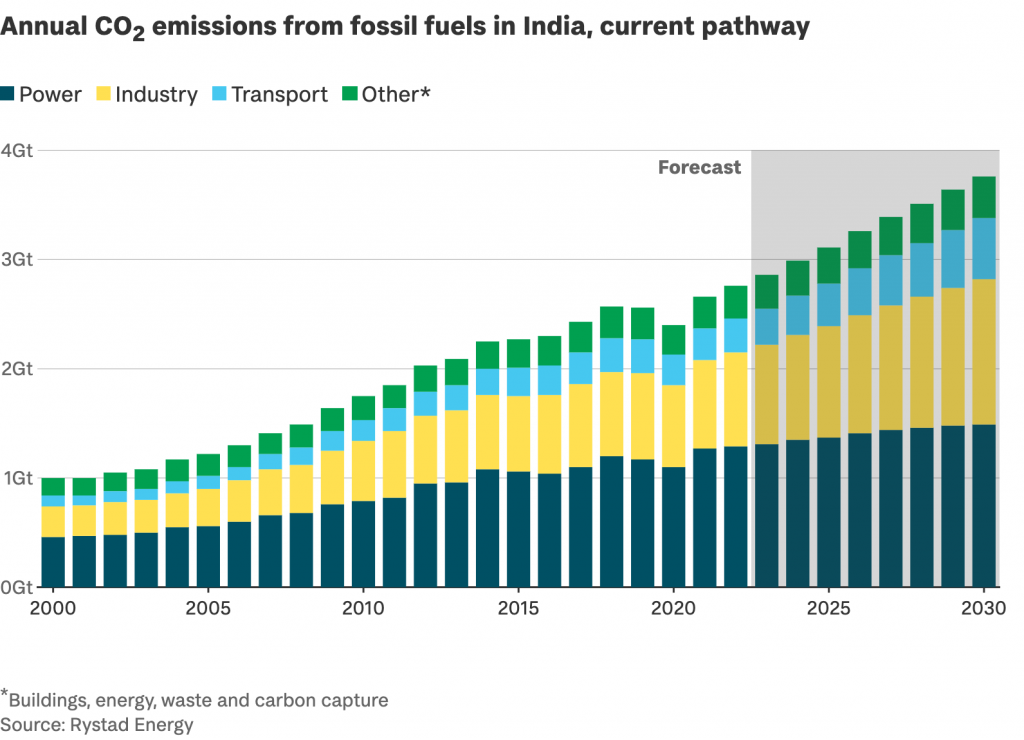

It’s in the developing world that this fight will be critical. The planet is decarbonizing – but the future isn’t evenly distributed.

While the US, EU and China are all on track to cut carbon emissions from fossil fuels this decade, India’s emissions will rise as its economy and population grows. Net zero needs the developing world to shift from coal to renewable energy rather than locking in the use of oil and, especially, gas as a bridge.

Ultimately, aligning the market and business with what society needs will require government action. This will be much harder to do if Big Oil is fighting to maintain long-term demand.

Lobbyists for Exxon let slip in undercover filming that the company’s support for a carbon tax is “an easy talking point” intended to stall progress.

Yet such taxes are the critical measure to price and reduce emissions. Businesses alone can’t get the world to net zero – but the oil and gas industry can stop blocking the way.